Audit-Ready Insights in Seconds

Turn messy spreadsheets and scattered policies into clear, cited financial analysis. Automate variance reporting, compliance audits, budget reconciliation, and risk assessments—with complete audit trails that satisfy SOX, GAAP, and regulatory requirements.

Why Finance Teams Need AI

Financial analysis is buried in spreadsheets, emails, and policy documents across multiple systems. Manual consolidation is slow, error-prone, and doesn't provide the audit trail regulators demand.

📊 Hours Spent in Excel

Comparing actuals vs. budget across 50+ cost centers requires downloading data from ERP, building pivot tables, calculating variances, and explaining outliers. By the time you finish, the data is stale. CFO wants answers in minutes, not days.

📂 Policies Buried Across Systems

Expense policies in SharePoint. Approval matrices in email. Budget guidelines in old Word docs. When auditors ask "Show me your capitalization policy," you spend hours searching. No single source of truth.

⏰ Quarterly Close Chaos

External auditors request 200+ documents during quarterly close. Your team scrambles to find supporting evidence for every material transaction. Missing documentation means findings and delays. Weeks of manual work.

📅 Lost Institutional Knowledge

"How did we handle this last year?" requires searching emails and asking colleagues. Finance analysts who handled prior audits have left. Knowledge gaps create risk and rework.

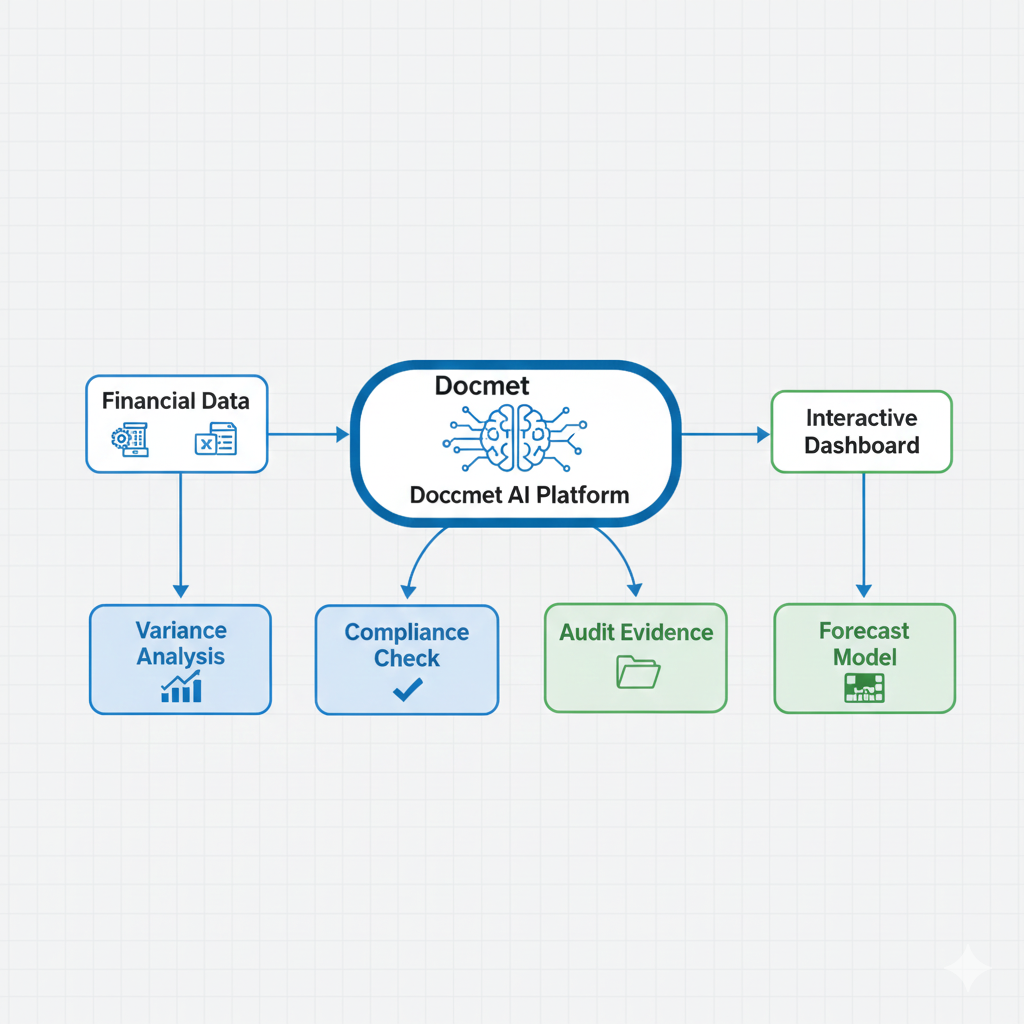

How Docmet Transforms Finance Workflows

Connect your financial data, policies, and historical records into an intelligent system that answers complex financial questions instantly—with full audit trails.

📈 "Compare Q3 Actuals vs. Budget"

Connect Docmet to your ERP (SAP, Oracle, NetSuite) or upload Excel exports. Ask natural language questions: "Show Q3 marketing spend variance by campaign." AI generates interactive tables and charts showing actuals vs. budget vs. forecast, with drill-down to line items. Export to Excel or PDF for board presentations.

📋 Instant Policy Answers

Index all financial policies (expense policies, capitalization rules, revenue recognition guidelines, internal controls). Ask: "What's our policy on software capitalization?" Get instant, cited answer with links to exact policy sections. Keeps compliance team audit-ready 24/7.

🔍 "Find Support for This Transaction"

Auditors request documentation for material transactions. Instead of searching emails and shared drives, ask Docmet: "Find all documents related to Q2 accrued expenses reversal." AI retrieves invoices, approval emails, policy references, and reconciliation memos—with dates and signatures.

📊 Multi-Period Comparisons

"Show revenue trend over last 8 quarters with commentary on major changes." AI generates line chart with annotations for significant events (acquisitions, product launches). Synthesizes management commentary from quarterly board decks. Saves hours of manual chart building.

✅ Compliance Mapping

New accounting standard (ASC 842, IFRS 17) requires policy updates. Upload new regulation. Ask: "Which of our policies need updates to comply with ASC 842?" AI maps regulation requirements to existing policies and highlights gaps. Generates compliance checklist.

💰 "Why Did We Budget This?"

Board asks why Engineering budget increased 30% in FY26 budget proposal. Docmet retrieves: hiring plan documents, strategic initiatives requiring headcount, compensation market analysis, and prior year actuals. Auto-generates justification memo with all supporting citations.

Finance Use Cases

Proven Finance Workflows

Quarterly Audit Preparation

Scenario: Fortune 500 bank undergoing quarterly external audit (Big 4 firm). Auditors request 187 supporting documents across revenue recognition, expense accruals, loan loss provisions, and internal controls.

Docmet Workflow:

- Audit Request Upload: Finance team uploads auditor's document request list (PBC list)

- Automated Retrieval: For each item, Docmet searches:

- General ledger exports (CSV from ERP)

- Supporting invoices and receipts (scanned PDFs)

- Approval email chains (Outlook integration)

- Policy documentation (internal controls manual)

- Prior period workpapers (archived Excel files)

- Evidence Compilation: AI assembles complete evidence package for each PBC item

- Narrative Generation: Creates explanatory memos citing sources

- Audit-Ready Delivery: Package exported with index, source citations, and date stamps

Results:

- Audit preparation time: 2 weeks (down from 10 weeks manual)

- 100% document completeness on first submission (zero follow-up requests)

- Auditors signed off 3 weeks ahead of schedule

- External audit fees reduced $150K due to efficiency

SOX Compliance Review

Scenario: Public company updating internal control documentation for Sarbanes-Oxley compliance. Need to verify all financial policies reflect current processes and identify control gaps.

Docmet Workflow:

- Policy Inventory: Upload 47 financial policies (expense approval, journal entry, bank reconciliation, etc.)

- Control Mapping: Map policies to SOX control objectives (Authorization, Segregation of Duties, Reconciliation, etc.)

- Gap Analysis: "Identify policies that don't address segregation of duties requirements"

- Policy Cross-Check: Find contradictions between policies (e.g., Policy A says $10K approval limit, Policy B says $5K)

- Update Recommendations: AI suggests specific language changes to close gaps

- Version Control: Track all policy updates with timestamps and approvers

Results:

- 15 control gaps identified and remediated before external audit

- Zero SOX deficiencies noted by auditors (vs. 3 findings prior year)

- Policy update project completed 8 weeks early

- Avoided potential material weakness designation

Budget vs. Actual Analysis

Scenario: Tech company's CFO presents quarterly business review to board. Needs to explain significant variances (>15%) across 12 departments and 200+ GL accounts.

Docmet Workflow:

- Data Integration: Connect Docmet to NetSuite (ERP) and Adaptive Insights (budgeting tool)

- Variance Query: "Show Q3 budget variance >15% by department with explanations"

- AI Analysis:

- Identifies 23 line items meeting variance threshold

- Retrieves related documents: headcount increase approvals, vendor contract amendments, one-time project expenses

- Finds prior quarter board deck commentary on expected increases

- Cross-references strategic initiative tracker

- Variance Report Generation: Creates deck-ready slides:

- Waterfall chart showing Q3 variance components

- Table of major variances with explanations and responsible executives

- Trend analysis showing if variance is one-time or recurring

- Executive Summary: 2-page memo for board packet

Results:

- Report preparation: 3 hours (vs. 2 days manual by FP&A team)

- Board had zero follow-up questions (comprehensive explanations)

- FP&A team freed up to focus on strategic analysis

- CFO NPS score from board increased from 7 to 9

Built for CFO Requirements

Enterprise Finance Capabilities

📋 Complete Activity Logging

Every financial query, document access, and AI-generated analysis is logged with timestamp, user ID, and data sources accessed. Audit logs are immutable (write-only) and retained for 7 years. Export to SOX compliance platforms. Meets Public Company Accounting Oversight Board (PCAOB) standards.

📊 Year-Over-Year Analysis

"Compare revenue by product line for last 3 fiscal years." AI consolidates data across fiscal periods, normalizes for accounting changes (e.g., ASC 606 adoption), and generates trend charts. Automatically accounts for acquisitions and divestitures.

📈 Three-Way Variance Analysis

Finance teams track not just budget vs. actual, but also latest forecast (reforecast) vs. actual. Docmet can handle complex three-way comparisons: "Show Q3 actuals vs. original budget vs. August reforecast with variance explanations." Generates rolling forecast views.

🔢 Auto-Compute Key Metrics

Ask for financial ratios and Docmet computes automatically: "Calculate current ratio for last 4 quarters." Retrieves balance sheet data, computes ratios, shows trends. Supports 50+ standard ratios (liquidity, profitability, efficiency, leverage). Useful for covenant compliance tracking.

✅ Budget Approval Chains

"Show approval history for Q4 marketing budget increase." Docmet retrieves approval emails, committee meeting minutes, and final authorization. Visualizes approval workflow (requester → dept head → CFO → board). Essential for SOX compliance demonstrations.

☑️ Month-End Close Assistant

Upload your financial close checklist (30-50 tasks). Docmet tracks completion status, retrieves supporting documentation for each task (bank recs, accrual schedules, depreciation calculations), and flags missing items. Accelerates close process and ensures nothing is overlooked.

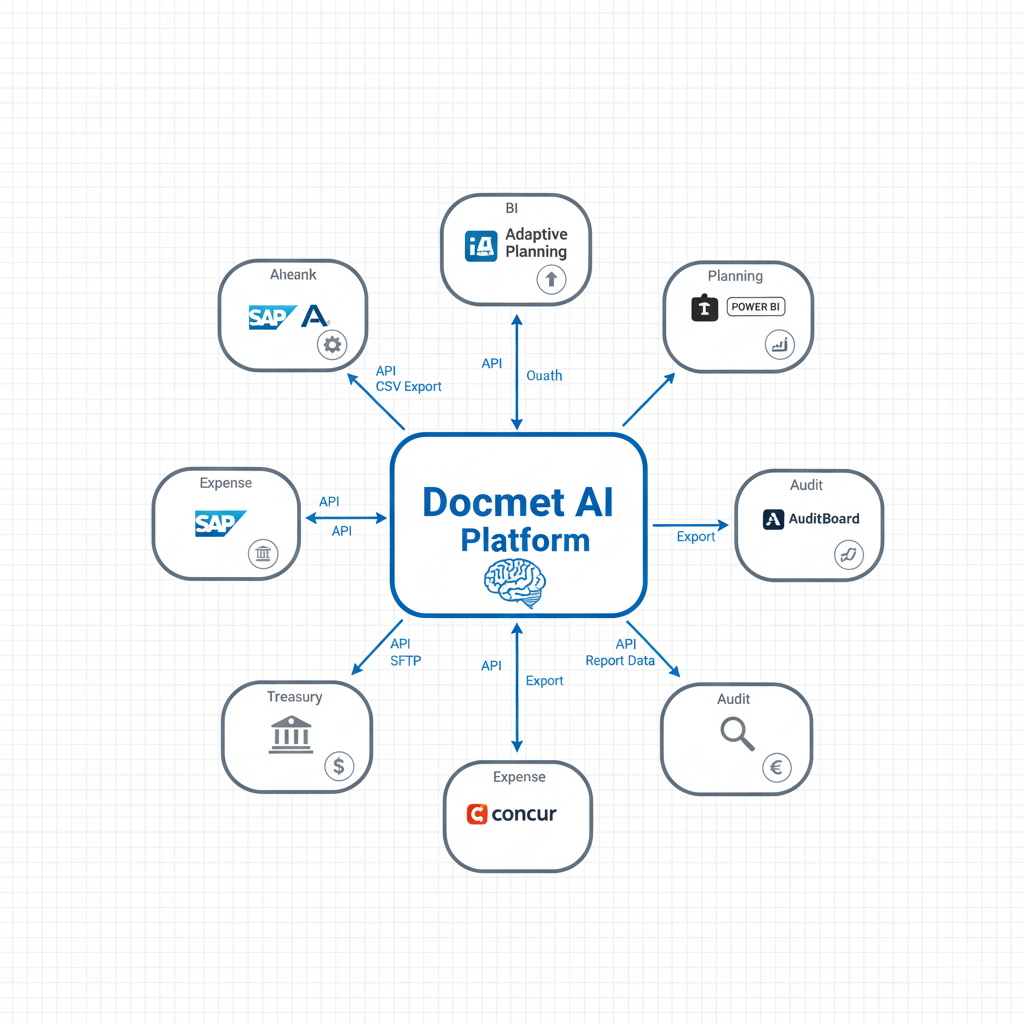

Connects to Your Financial Stack

Seamless Integration

🏢 Major ERP Platforms

Supported: SAP (S/4HANA, ECC), Oracle (EBS, Fusion), Microsoft Dynamics 365, NetSuite, Sage Intacct. Method: API integration (real-time) or scheduled data exports (CSV/Excel). Data: General ledger, AP/AR, fixed assets, bank reconciliations. Query live data without leaving Docmet.

📊 FP&A Platforms

Supported: Adaptive Insights (Workday), Anaplan, Prophix, Board, Vena. Use Case: Compare actuals (from ERP) to budget/forecast (from planning tool) in single view. "Show Q3 variance by cost center." No more manual data reconciliation.

📈 Business Intelligence

Supported: Tableau, Power BI, Qlik, Looker. Integration: Docmet can query your BI dashboards and retrieve underlying data. Ask: "What's driving the revenue drop shown in yesterday's board dashboard?" AI finds source data and explanations.

✅ GRC Tools

Supported: AuditBoard, Workiva, SAI360, MetricStream. Use Case: Stream Docmet audit trails to your GRC platform. Link evidence collected by Docmet to control testing workpapers. Automate PBC (Prepared by Client) list responses.

💳 T&E Systems

Supported: Concur (SAP), Expensify, Chrome River, Certify. Use Case: "Show all expense reports >$5K flagged for policy violation in Q3." Cross-reference expense submissions with policy documents and approval chains.

🏦 Cash Management

Supported: Banking APIs (via secure file transfer), Kyriba, GTreasury. Use Case: Retrieve bank statements and reconciliation files. "Show unreconciled items >90 days old." Link to supporting documentation.

Audit-Grade Reliability

Verified results from finance deployments

Audit Documentation Completeness

First-time submission to external auditors

Faster Audit Preparation

Weeks reduced to days

SOX Control Deficiencies

After Docmet implementation

Average Annual Savings

Per finance department

*Based on controlled studies with Fortune 500 finance organizations (2025)*

From Pilot to Department-Wide in 4 Weeks

Proven deployment process for finance teams

Data & Policy Foundation

Identify and integrate financial data sources (ERP, budgeting tools, Excel). Set up secure APIs or scheduled exports, configure chart of accounts mapping, and validate data accuracy with sample queries. Upload financial policies, internal controls, prior audit workpapers, board decks, and management commentary. Configure taxonomy (fiscal periods, cost centers, GL accounts) and build an AI knowledge graph linking policies to underlying data.

Use Case & Access Configuration

Configure core finance and audit use cases including variance analysis, audit evidence retrieval, policy search, and financial ratio calculations. Set up role-based access control (FP&A, Controllers, Audit Committee). Train the AI on company-specific terminology such as department names, product lines, and metric definitions.

Training, Rollout & Optimization

Conduct training for CFO, Controllers, and FP&A teams (2-hour session) with live demos using real quarterly close scenarios. Roll out to the broader finance team, monitor adoption and usage patterns, refine workflows based on feedback, and schedule the first quarterly business review.

Finance ROI

Calculate Your Finance ROI

Finance Department ROI Model

Assumptions (Fortune 500 company):

- Finance team: 25 FTE (mix of Controllers, FP&A analysts, Accountants)

- Quarterly close & audit preparation: 4 weeks per quarter = 16 weeks/year

- Hours per person per close: 60 hours × 25 FTE = 1,500 hours per quarter

- Average fully-loaded cost per FTE: $150K annually = $75/hour

- External audit fees: $500K annually

Without Docmet:

- Quarterly close labor: 1,500 hours × $75 = $112,500 per quarter

- Annual close labor: $450K (4 quarters)

- External audit fees: $500K

- Total annual cost: $950K

With Docmet:

- Audit prep time reduced 90%: 1,500 hours → 150 hours per quarter

- Quarterly close labor: 150 hours × $75 = $11,250 per quarter

- Annual close labor: $45K (4 quarters)

- External audit fees reduced 30% via efficiency: $350K

- Docmet subscription (Business plan): $6K annually

Annual Savings:

- Close labor savings: $405K

- Audit fee savings: $150K

- Total savings: $555K

- Net ROI: 9,150% (91.5x subscription cost)

- Payback period: < 1 week

Additional Benefits (Not Quantified Above)

- Faster Board Reporting: CFO spends 70% less time preparing board decks

- Risk Reduction: Zero SOX deficiencies (prior year had 3 findings)

- Strategic Time: FP&A team reallocates 40% of time from data gathering to strategic analysis

- Employee Retention: Finance team satisfaction increases (less grunt work)

What Finance Leaders Say

From the CFOs and Controllers using Docmet

“"The ability to map 15 years of disconnected policy documents into a single Knowledge Graph saved us from a regulatory nightmare. We identified 400+ outdated policies still in circulation and remediated them before our SEC audit. Docmet's audit trail gave examiners complete confidence in our compliance program. Worth every penny."”

Transform Your Finance Operations

See how Docmet automates variance analysis, accelerates audit preparation, and ensures compliance. Schedule a demo with finance-specific scenarios and your actual data.

Common Finance Questions

Finance FAQ